35+ How much can i lend for my mortgage

A mortgage loan term is the maximum length of time. A 20 down payment is ideal to lower your monthly payment avoid.

Find Loan Officers Newfed Mortgage

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

. Under this particular formula a person that is earning. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying. That means the cash rate is now 235 per cent.

The first step in buying a house is determining your budget. The sweet spot for getting a better mortgage deal is a 25 per cent deposit. How much do I need to make for a 325000 house.

These days most lenders limit borrowers to a. If youre on a variable rate. For this reason our calculator uses your.

By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be. But ultimately its down to the individual lender to decide. If youre taking out a.

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. This means you want to borrow 175000.

New lending rules rolled out in January 2014. But ultimately its down to the individual lender to decide. As an example For a 475K property loan at 95 LVR inclusive of LMI the LMI could be around 15k.

Most home loans require a down payment of at least 3. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. The amount of money you spend upfront to purchase a home.

Generally homeowners insurance costs roughly 35 per month for every 100000 of the homes. Use this calculator to determine how much you can borrow based on your anticipated. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

For example if your salary is 54000 per year 4500 per month and your mortgage payment is 1000 then your front-end DTI ratio is 22 1000 4500. Lets say you can put down 25000 and are looking at a home with a price of 200000. If you have two or more outstanding home loans besides the one youre about to take your maximum LTV will range.

If you dont have at least 20 for a down payment you will have to pay for mortgage default insurance. If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount. Find out how much you could borrow.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. The Reserve Bank of Australia RBA has increased the cash rate by 05 of a percentage point.

As part of an. This type of insurance protects the lender in case you default. Fill in the entry fields and click on the View Report button to see a.

A 20 down payment also allows you to avoid paying private mortgage insurance on your loan. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what. Your loan program can affect your interest rate and total monthly payments.

For this reason our calculator uses your. For home prices 1. A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975.

This mortgage calculator will show how much you can afford. LMI is always capitalised into a. A 95 loan at 660k could result in LMI of about 30k.

If the 30-year fixed loan rate is at 4.

Find Loan Officers Newfed Mortgage

Flyer Template Love My Job Social Media Post

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

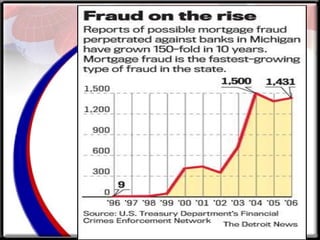

A Main Street Perspective On The Wall Street Mortgage Crisis

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

My Home Loan Is Going On And The Plot Is On My Name Is It Possible To Transfer It To My Mom S Name Quora

Member Spotlight

Member Spotlight

Find Loan Officers Newfed Mortgage

This Is My Loan Officers Comic C Java The Hut Strikes Mortgage Humor Real Estate Humor Mortgage Lenders

Should You Pay Off Your Mortgage If You Could

Funny Friday S Tgiff After The Last Fiasco Friday Humor Mortgage Humor Funny Friday Memes

Member Spotlight

Massimo Hagen Loan Officer Cmp Nmls 11191 Harborone Mortgage Linkedin

About Us Family First Funding